trust capital gains tax rate 2022

AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches 539900 for single filers and 1079800 for married taxpayers filing jointly Table 4. The IRS typically allows you to exclude up to.

2021 Trust Tax Rates And Exemptions

If the gains push you into the higher tax band you pay 20.

. The standard rules apply to these four tax brackets. Capital Gains Tax rates 202223 for trustees If you are a trustee or the personal representative of someone who has died the CGT rates are a bit simpler. The 0 rate applies to amounts up to 2800.

So for example if a trust earns 10000 in income during 2021 it would pay the following taxes. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. 28 on residential property 20 on chargeable assets.

Trust tax rates are very high as you can see here. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. In 2022 the 28 percent AMT rate applies to excess AMTI of 206100 for all taxpayers 103050 for married couples filing separate returns.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. 20 for trustees or for. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Most personal use assets. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended.

What about CGT allowances and reliefs. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home.

In other words if you are falling in 28 tax bracket short term capital gains in your hand will be will be taxed 28. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The maximum tax rate for long-term capital gains and qualified dividends is 20.

For tax year 2022 the 20 rate applies to amounts above 13700. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050. Venture Capital Trust VCT 30 relief.

250000 of capital gains on real estate if youre single. Short term capital gains are taxed at the same tax rate that is applied to your normal income. Discover Helpful Information and Resources on Taxes From AARP.

National Insurance Contributions Class 1 Employees Employee Employer. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

Earned Income Tax Credit EITC. The following are some of the specific exclusions. Tax rate tables for 202223 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates.

500000 of capital gains on real. Long term capital gains are taxed on lower rates -maximum is 20. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

4 rows The IRS has already released the 2022 thresholds see table below so you can start planning for. 0 2650. Capital Gains Tax.

Table of Current Income Tax Rates for Estates and Trusts 202 1. 2022 Capital Gains Tax Rate Thresholds The tax rate on short-term capitals gains ie from the sale of assets held for less than one year is the same as the rate you pay on wages and other. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Ad Compare Your 2022 Tax Bracket vs. Trusts Estates tax rates 2022 AVE 2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for heads. For example if you purchased real property for 400000 and sold it ten years later for 500000 you would realize a gain of 100000.

Determining when capital gains taxes are due how to calculate the gain upon which the tax is paid and how much tax is due can be quite complicated because of the numerous and varied factors involved and the. R2 million gain or loss on the disposal of a primary residence. The 15 rate applies to amounts between the two thresholds.

The 0 and 15 rates continue to apply to amounts below certain threshold amounts. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

Your 2021 Tax Bracket to See Whats Been Adjusted. Capital gains tax rates on most assets held for a. State taxes are in addition to the above.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

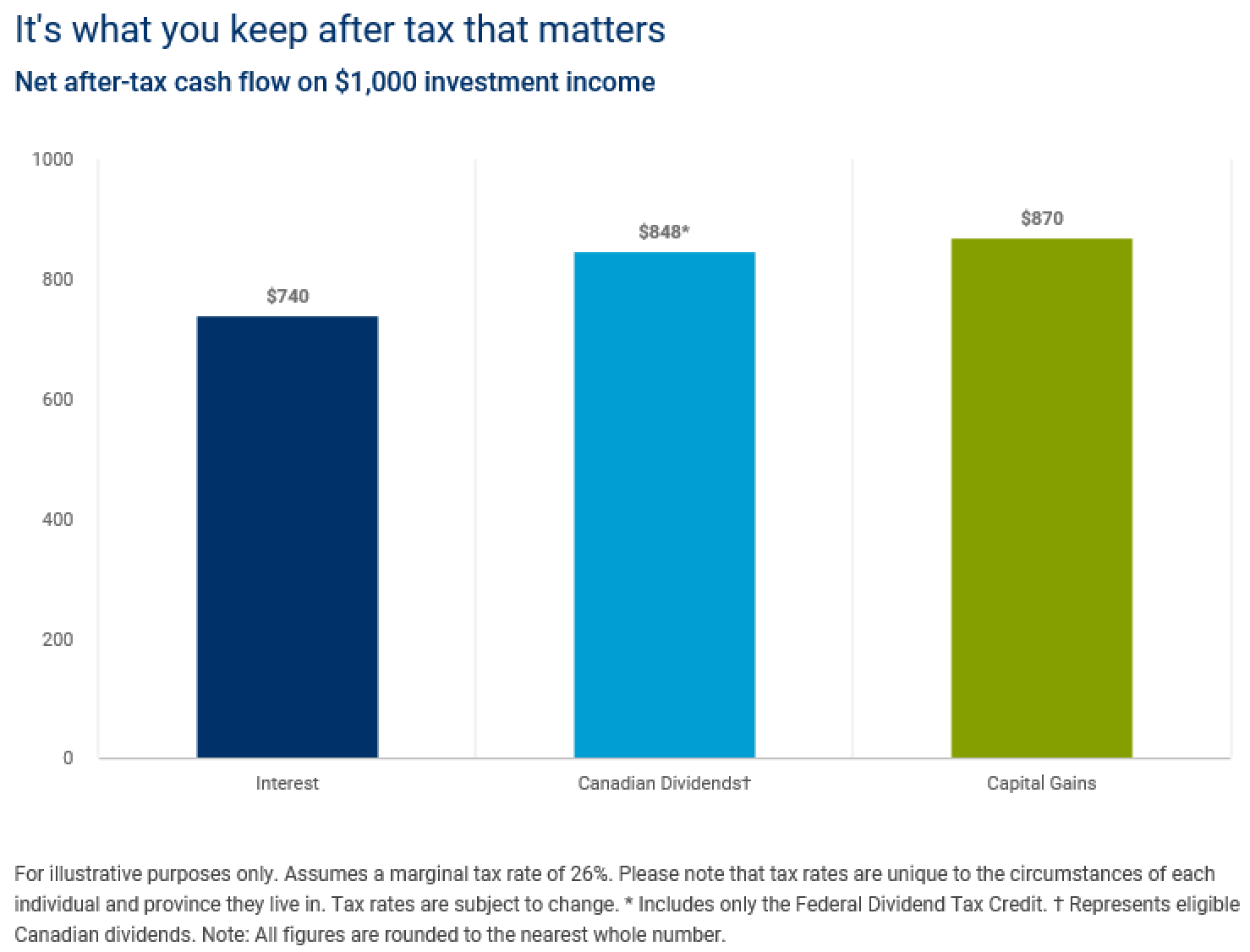

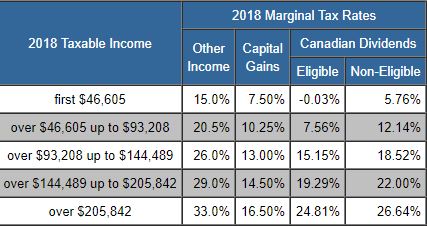

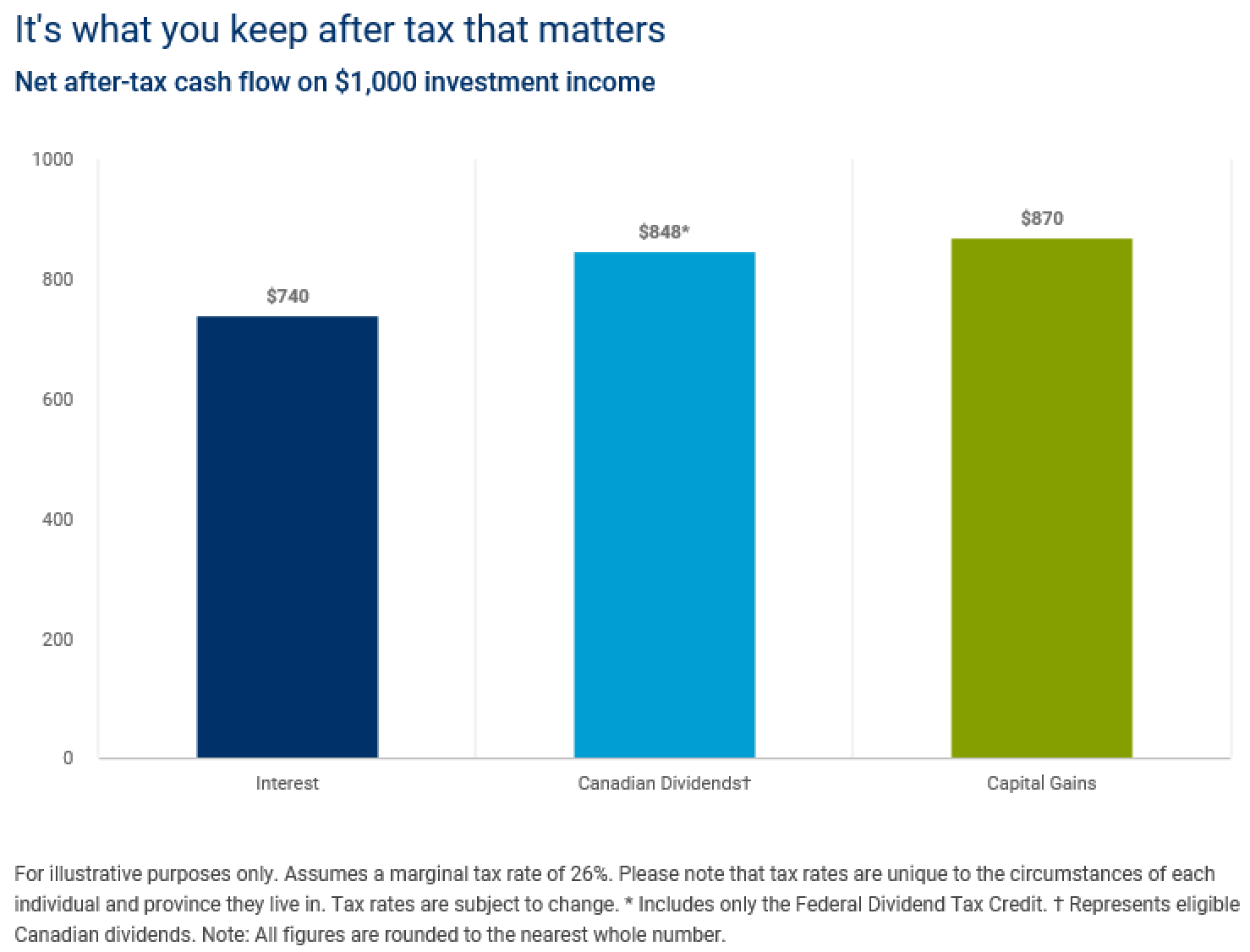

Whitehead Wealth Management Blog 11 Non Registered Accounts And Taxes

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

9 Expat Friendly Countries With No Capital Gains Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Stacey Staceylynnhaslett Instagram Photos And Videos Investing Finance Capital Gains Tax